Volusion Payments Buy Now Pay Later

Increase Conversions with Financing options available through Volusion Payments

Volusion Payments now offers additional financing payment options through Affirm , Afterpay , and Klarna.

1. Why BNPL's

-

Buy now, pay later has emerged as one of the most popular payment methods: More than half of US customers have used a buy now, pay later service, and almost 10% of e-commerce transactions in Australia are paid using a buy now, pay later provider. It was the fastest-growing payment method in 2020 in India and the UK, and analysts estimate that these services will account for 12% of total global e-commerce spend on physical goods by 2025.

-

Buy now, pay later services-- such as Affirm, Afterpay, Klarna, and Zip--are used by a wide variety of businesses, especially ecommerce retailers, to increase conversion, increase average order value, and reach new customers. Businesses that accept buy now, pay later services on Stripe have seen a 27% incremental uplift in sales volume. These payment methods offer customers the ability to immediately finance purchases and pay them back in fixed installments over time.

2. What are BNPL's?

-

Buy now, pay later (BNPL) is an alternative payment method that allows customers to purchase products and services without having to commit to the full payment amount up front. In doing so, customers have the ability to immediately finance purchases and pay them back in fixed installments over time. For example, a customer making a $100 purchase could pay for the item in four interest-free installments of $25.

-

You, as the merchant, receive the full payment of the item up front, minus any fees (just like a credit card payment), and don't have to manage the financing. The buy now, pay later providers take on the task of underwriting customers, managing the installments, and collecting payments, so you can focus on growing your businesses.

1. Log into the Stripe Dashboard

2. Click the 'Settings Wheel' in the upper right corner.

3. Click the link labeled 'Payments'.

4. Then select "Payment Methods"

5. From there, you will click on Default - Volusion account. It should be the second option.

6. Now you can scroll down until you see Affirm, Afterpay, and Klarna.

7. You will hover your cursor (mouse) on the line of the Buy Now Pay Later you would like to enable. You should see an “Enable” button show on the right side. This will enable that specific Buy Now Pay Later option.

![]()

These options will now display on your product, shopping cart and checkout pages!

Options and Information displayed on your storefront:

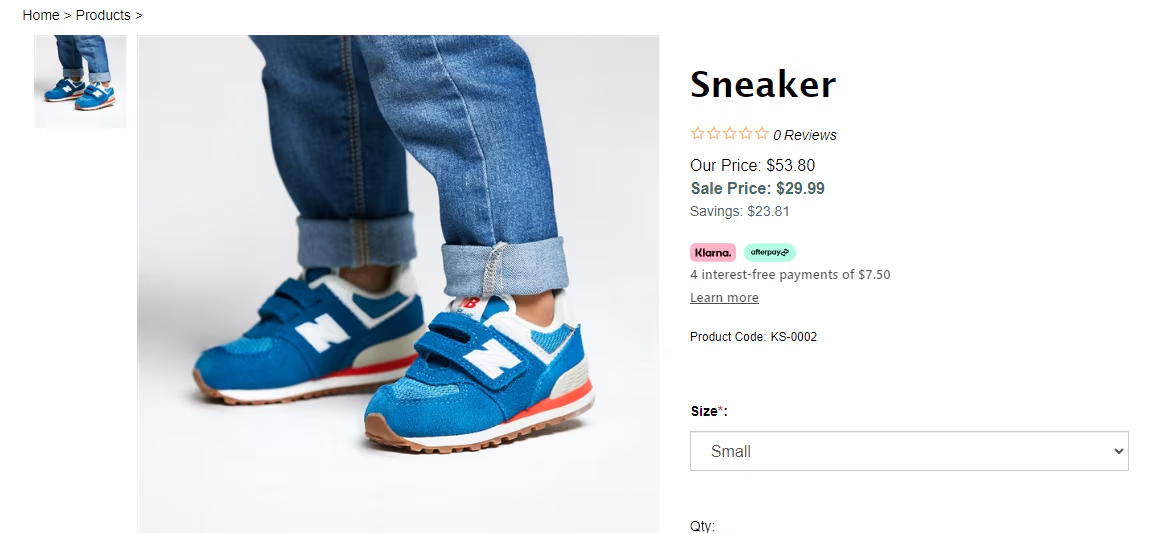

Product Pages:

Qualifying products will now display information about these payment options under the pricing section. The customer is able to review the terms and conditions by clicking the Financing buttons.

*Note on Disqualified products:

Each Financing company has different restrictions for certain types of products. You can review these restrictions within Stripe's Documentation .

There are types of Volusion products that will not display Financing options:

Donation Products.

Recurring Billing Products.

The Gift Certificate Product.

Example of how it displays on the product page:

The customer can review financing information, and terms and conditions by clicking the Financing options buttons.

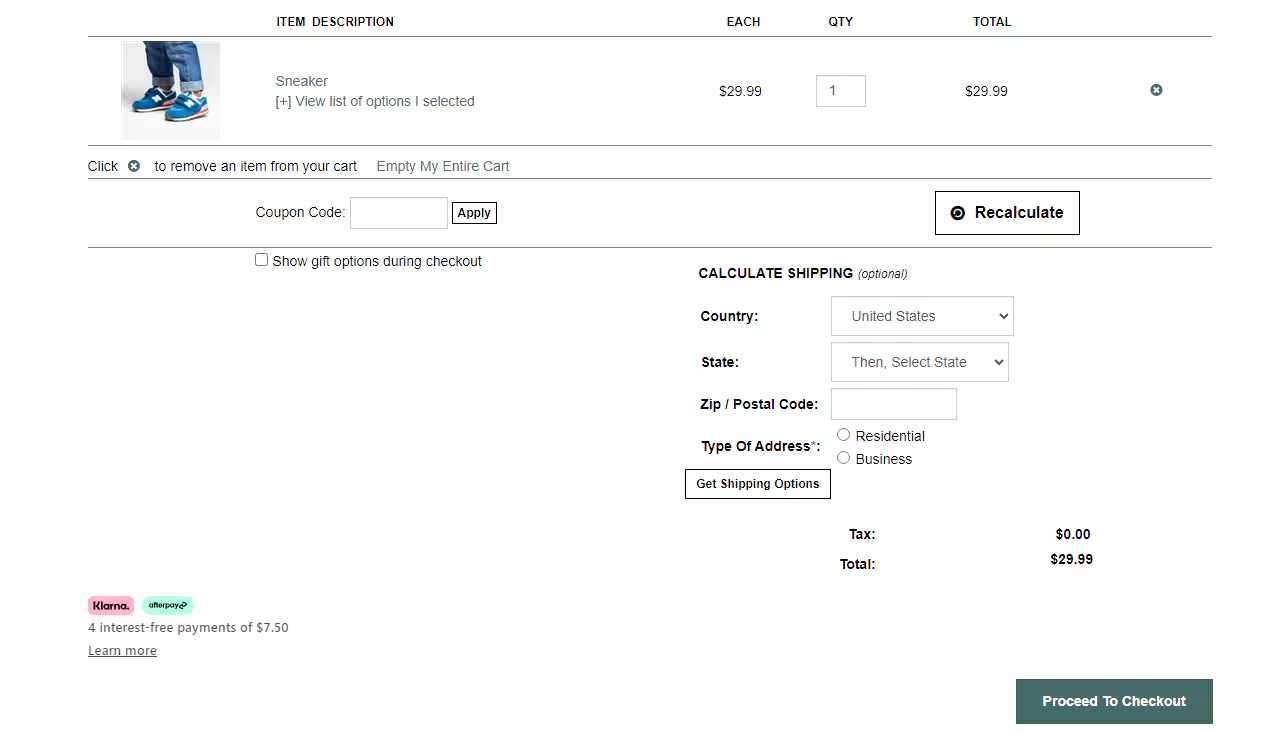

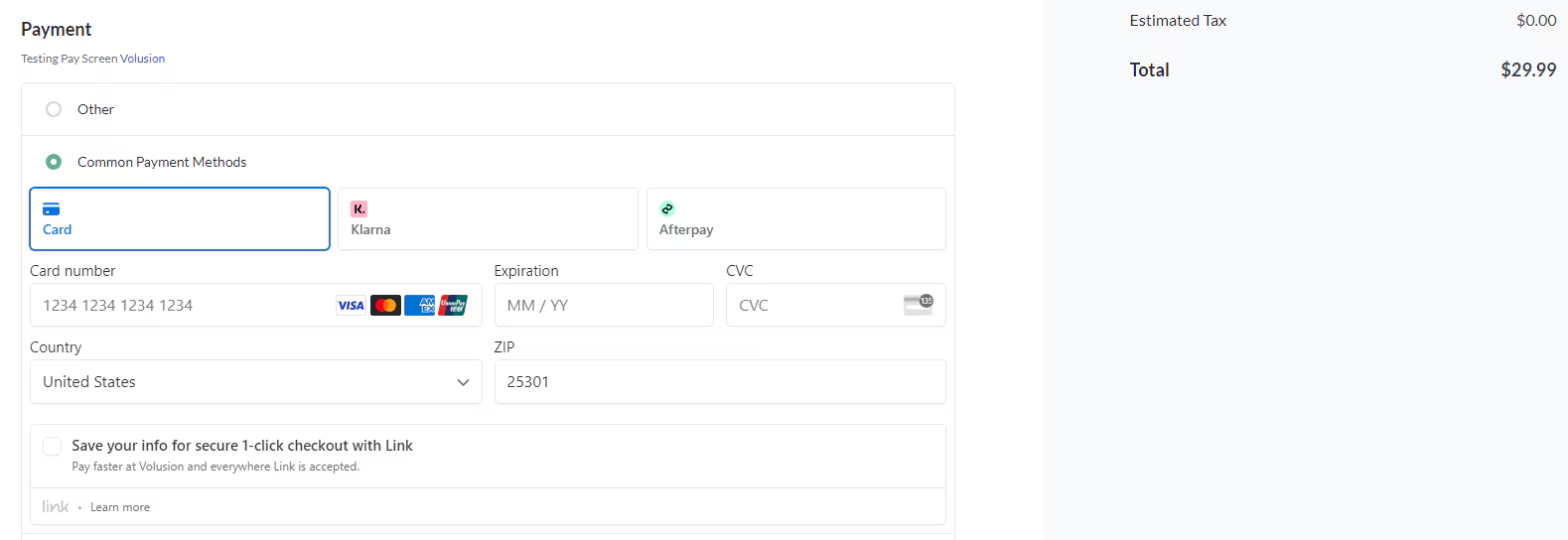

Checkout Page:

The Checkout page will offer these options in the Payment Section.

These Financing options mean that the merchant is paid in full up front for these orders. The customer will make the payments directly through the financing companies after the order has been placed.

If the Customer abandons or declines the financing option:

The customer will be brought back to the checkout page where they will be able to place the order using a different payment method of their choosing.

Orders will show as automatically captured in the Process Orders page. This will happen regardless of the Capture Settings. If your store is configured with the 'Manual Authorize and Manual Capture' setting, these options will not be available. For more on payment capture settings , please see our Managing Your Payment Settings article.

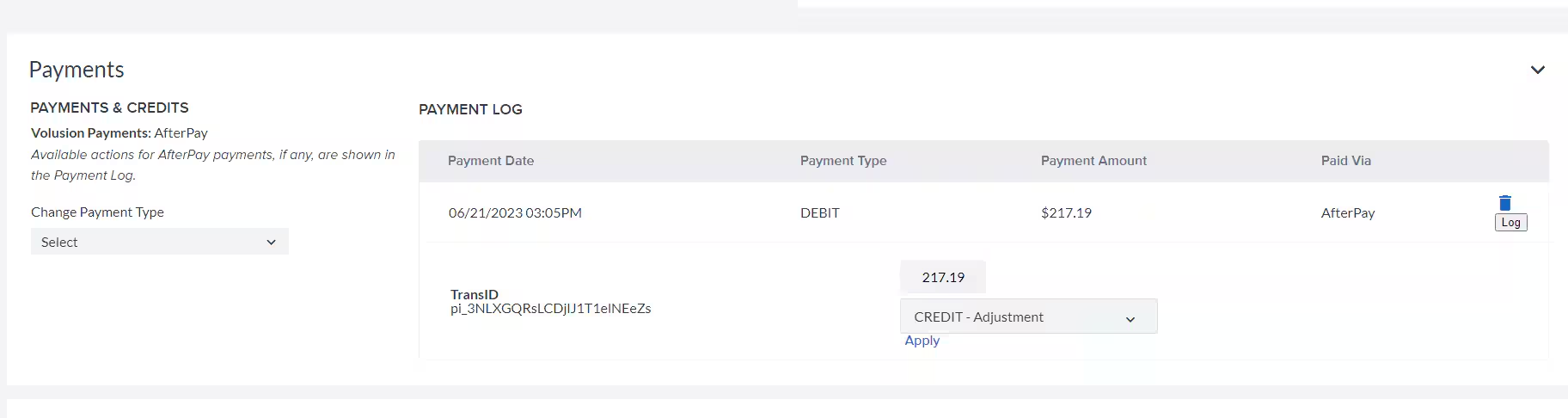

What Happens If a Customer Wants a Refund?

- Each Buy Now Pay Later provider has slightly different rules when it comes to issuing refunds however, typically, returns are subject to the return policy that you display on your website. If your business allows returns, you can refund transactions as you normally would for card payments. Most providers support partial or full refunds for up to 120 days after the original purchase and process them asynchronously. After Stripe initiates a refund, the Buy Now Pay Later provider pauses the customer's payment plan and refunds the customer for any payments they've already made, minus any interest paid.

What Happens If a Customer Issues A Chargeback?

- Each Buy Now Pay Later provider has different rules when it comes to chargebacks/disputes. For more information on how each provider operates when one of these occurs, please refer to the following documentation.

The following article provides more information about the ins and out's of the Buy Now Pay Later Process

Activating Buy Now Pay Later messaging on Site Designer:

1. Log into your Admin Dashboard, and hover over the 'Design' menu and then click Site Designer.

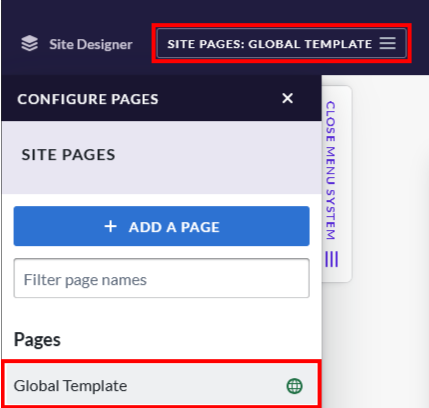

2. Click the Site Pages button, and select "Global Template" from the Pages list

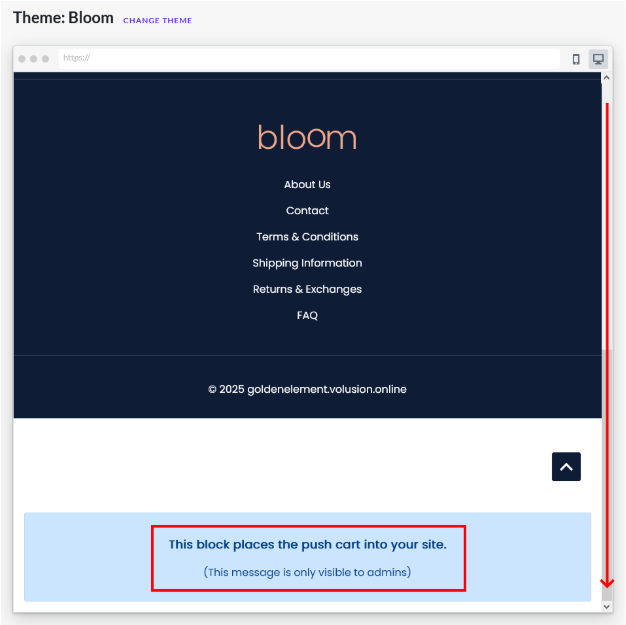

3. Scroll down the page to the very bottom, and click the blue box with the text "This block places the push cart into your site."

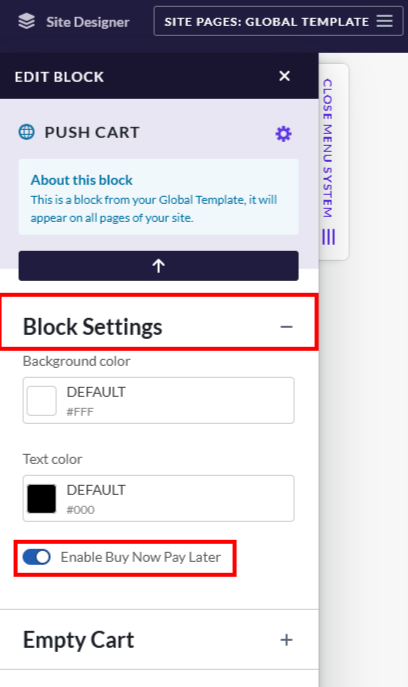

4. In the sidebar, expand the "Block Settings" section, and turn the toggle for "Enable Buy Now Pay Later" to the on setting

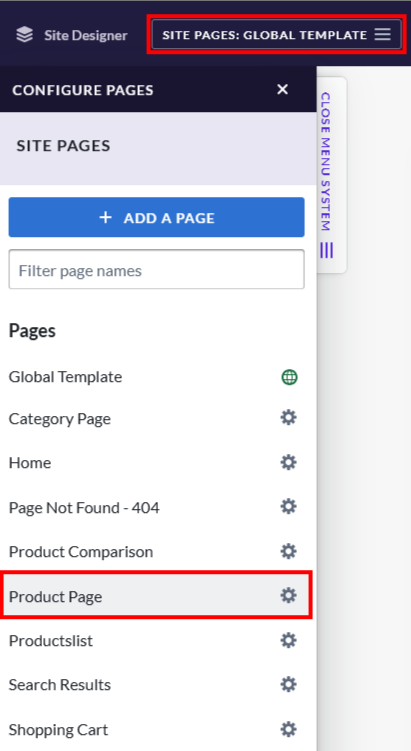

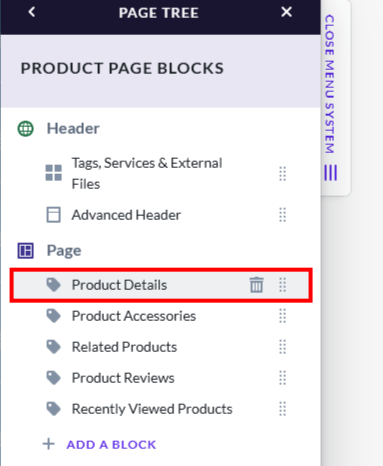

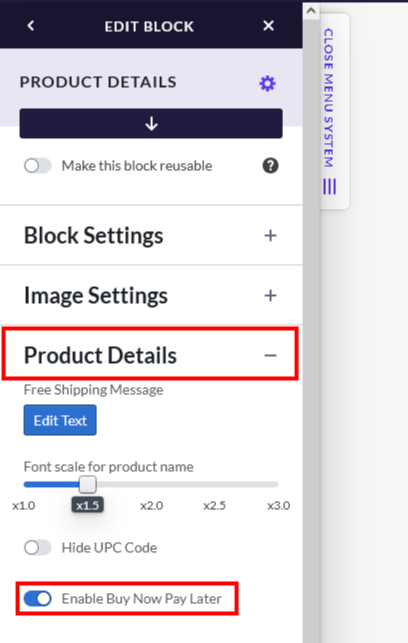

5. Click the Site Pages button again, and this time select "Product Page" from the Pages list

6. Click "Product Details" from the Product Page Blocks list

7. Expand the Product Details section, and turn the toggle for "Enable Buy Now Pay Later" to the on setting

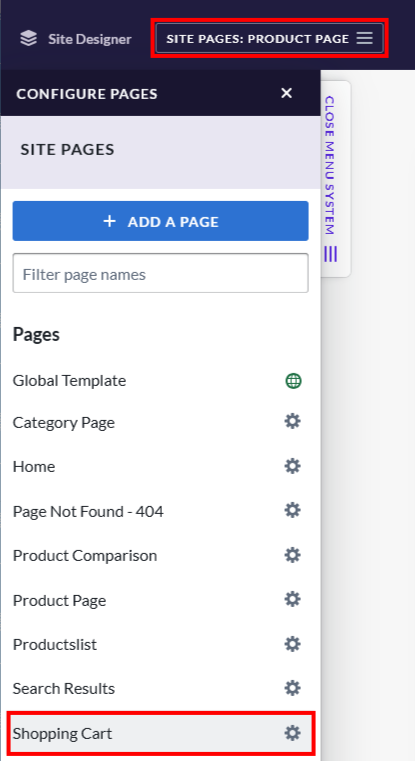

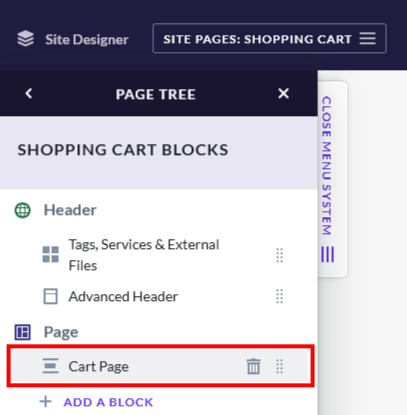

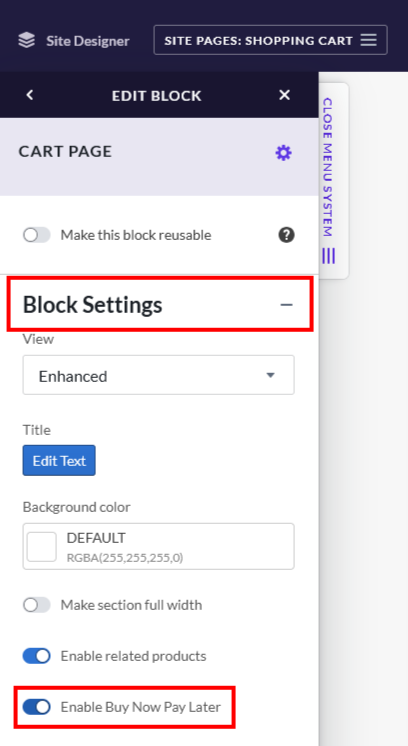

8. Click the Site Pages button again, and this time select "Shopping Cart" from the Pages list

9. Click "Cart Page" from the Product Page Blocks list

10. Expand the Block Settings section, and turn the toggle for "Enable Buy Now Pay Later" to the on setting

11. Click the green "PUBLISH" button to publish the changes to the storefront!

Summary