How to Change GST or VAT Display

How to Change GST or VAT Display

The text for your VAT and GSD tax information can be edited to change your storefront display.

Written by�Jared K

If you run your store from the UK or Australia where VAT or GST is in operation, you need to set up how these taxes display on your storefront. You can configure these settings in your Admin Area by going to Settings > Tax and clicking Settings at the top of the page.

�

These taxes, and whether they are included or excluded in the displayed prices, then show on your storefront.

�

If you want to tailor the exact wording of how the tax displays, Volusion allows you to edit the text. To do so:

�

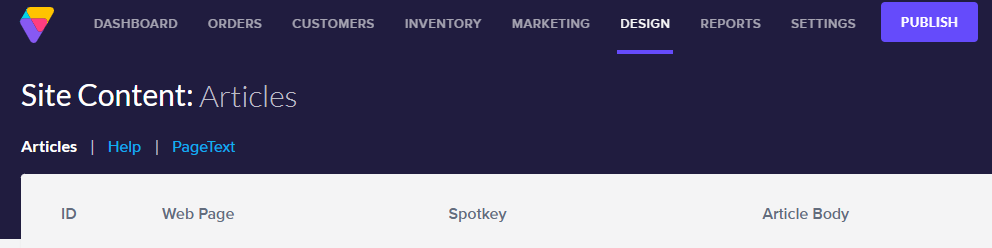

Go to Design > Site Content.

�

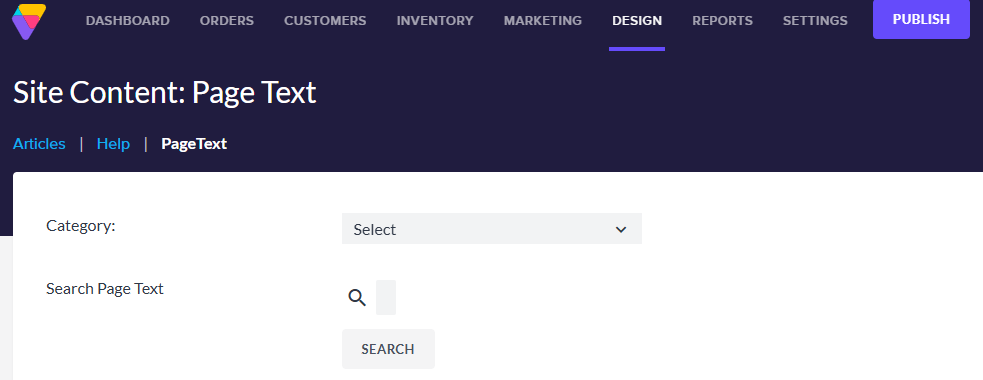

Select Page Text from the Article Type menu.

�

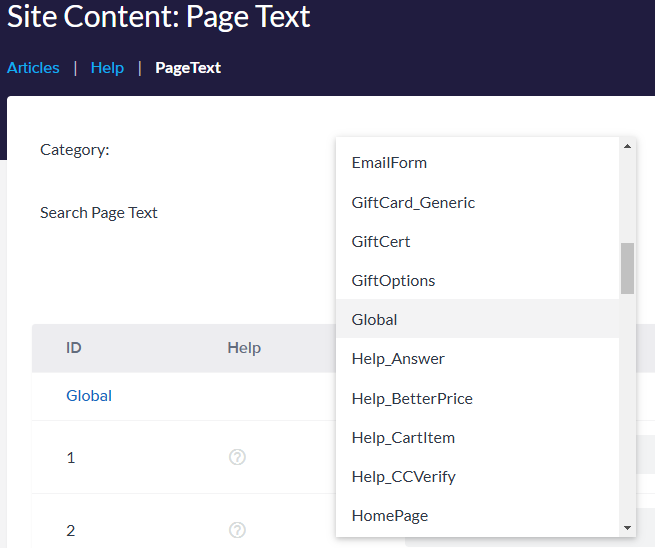

When the table refreshes, select Global from the Category menu.

�

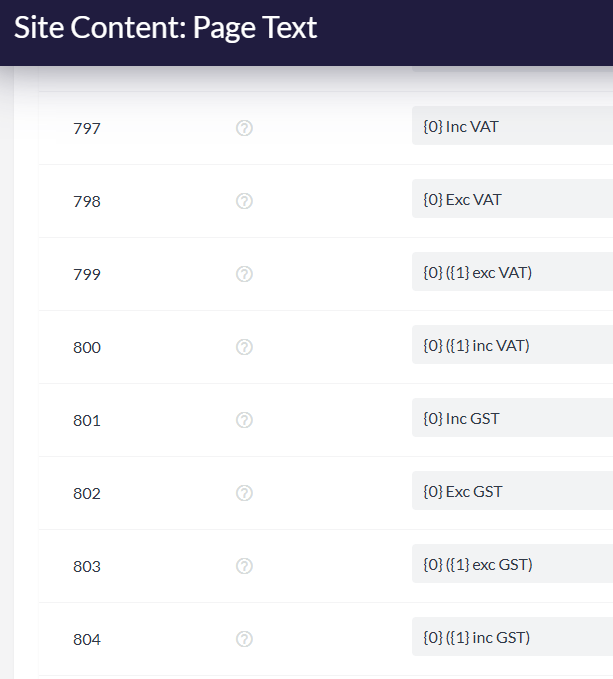

Scroll down to the bottom of the table. Here you will find Articles 797 - 804, which contain the text that displays for prices related to VAT and GST.

�

Edit these values as appropriate. Be careful not to delete or alter the "{0}" and "{1}" field variables; they are needed to show the before & after-tax prices. Click Save to finish your changes.

�

Important Note

Note that you cannot make these edits from the storefront using the Edit link.

�

Shopping Cart and Checkout Text

Merchants in other regions (for example, Canadian merchants charging HST) may find this functionality particularly helpful. To change the text on the shopping cart and checkout pages, follow these steps:

�

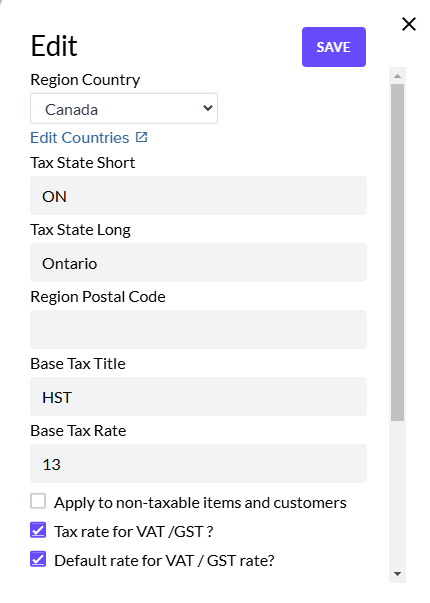

Go to Settings > Tax.

�

Click Edit next to the appropriate rate.

�

Edit the text in the Base Tax Title field as you like. Click Save to finish your edits.